Study and Reports on the VAT Gap in the EU-28 Member States: 2017 Final Report - CASE - Center for Social and Economic Research

https://t.co/LLdVPzqUTB… "" title="EU Tax & Customs 🇪🇺 в Twitter: "#VAT Gap (difference between expected and collected VAT revenue) per country. Full report > https://t.co/LLdVPzqUTB… "">

https://t.co/LLdVPzqUTB… "" title="EU Tax & Customs 🇪🇺 в Twitter: "#VAT Gap (difference between expected and collected VAT revenue) per country. Full report > https://t.co/LLdVPzqUTB… "" />

https://t.co/LLdVPzqUTB… "" title="EU Tax & Customs 🇪🇺 в Twitter: "#VAT Gap (difference between expected and collected VAT revenue) per country. Full report > https://t.co/LLdVPzqUTB… "" />

https://t.co/LLdVPzqUTB… "" title="EU Tax & Customs 🇪🇺 в Twitter: "#VAT Gap (difference between expected and collected VAT revenue) per country. Full report > https://t.co/LLdVPzqUTB… "" />

https://t.co/LLdVPzqUTB… "" title="EU Tax & Customs 🇪🇺 в Twitter: "#VAT Gap (difference between expected and collected VAT revenue) per country. Full report > https://t.co/LLdVPzqUTB… "" />

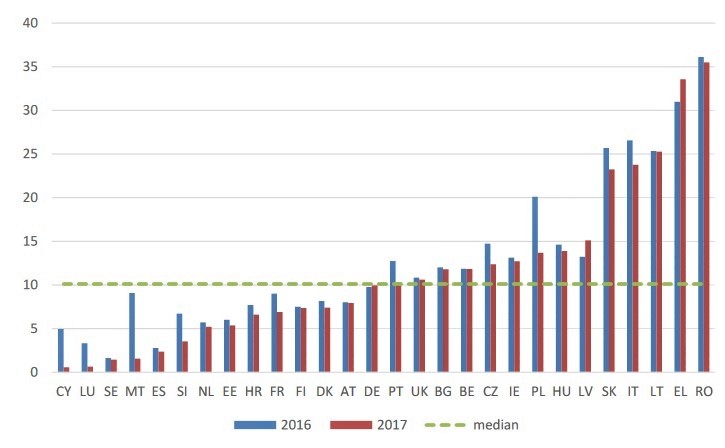

EU Tax & Customs 🇪🇺 в Twitter: "#VAT Gap (difference between expected and collected VAT revenue) per country. Full report > https://t.co/LLdVPzqUTB… "

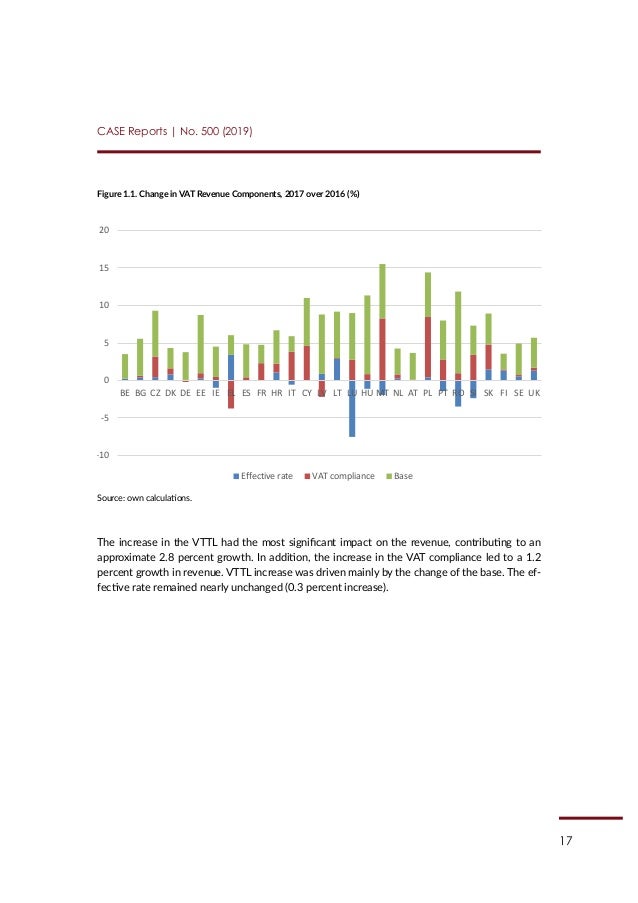

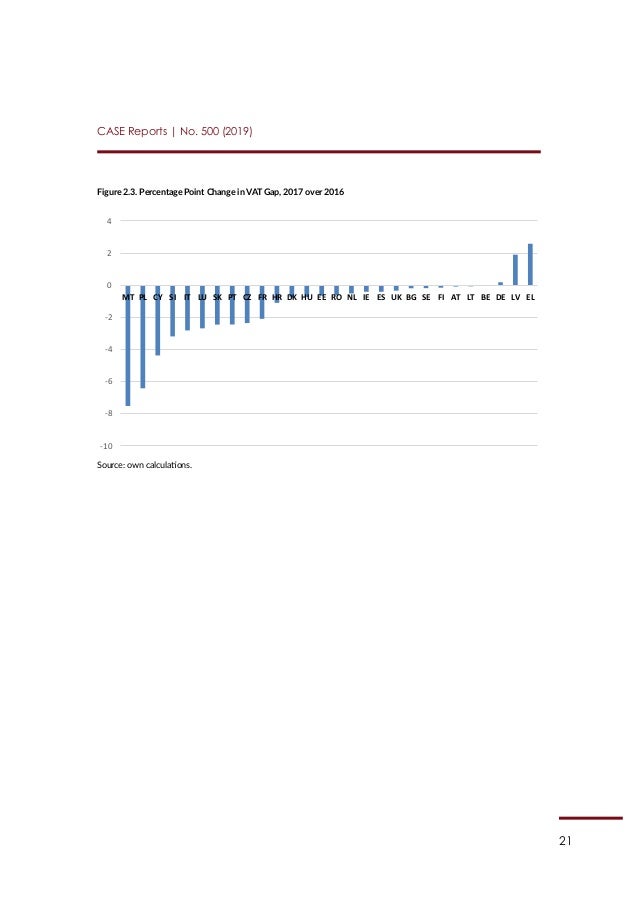

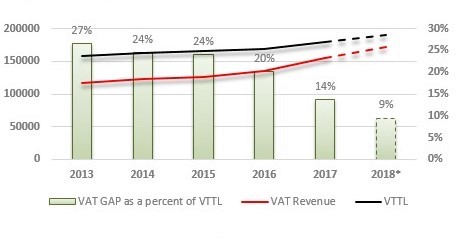

CASE REPORT: an 8 % increase in VAT revenue due to increased compliance, and a 6 % increase due to favourable economic climate - CASE - Center for Social and Economic Research

Study and Reports on the VAT Gap in the EU-28 Member States: 2017 Final Report | Value Added Tax | Taxes

CASE REPORT: an 8 % increase in VAT revenue due to increased compliance, and a 6 % increase due to favourable economic climate - CASE - Center for Social and Economic Research

EUROPEAN COMMISSION Brussels, 30.11.2017 SWD(2017) 428 final COMMISSION STAFF WORKING DOCUMENT IMPACT ASSESSMENT Accompanying t