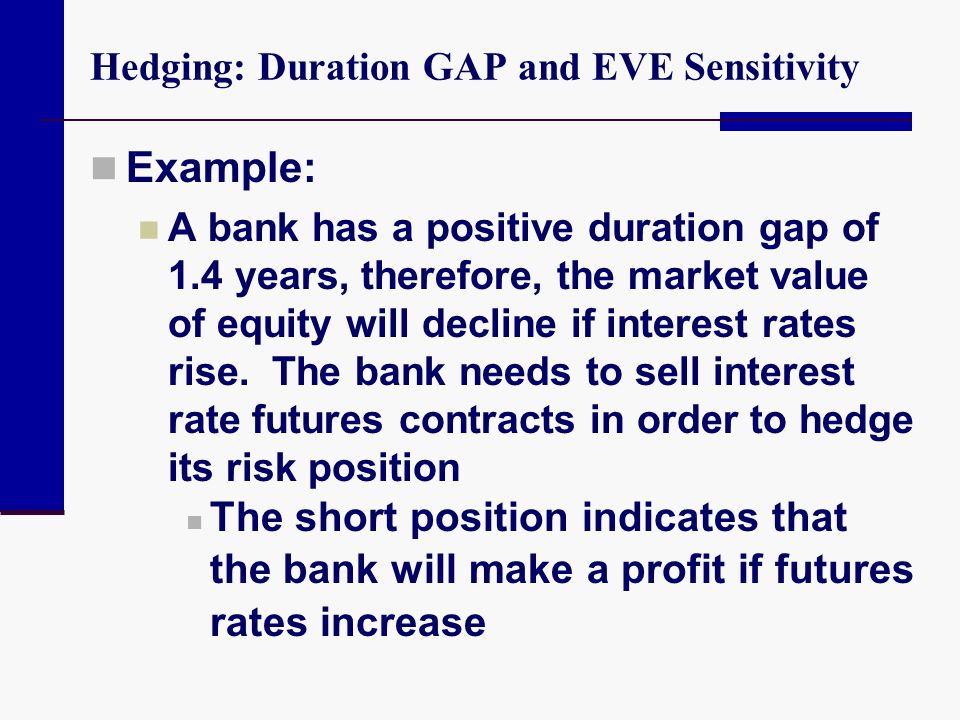

Derivatives in ALM. Financial Derivatives Swaps Hedge Contracts Forward Rate Agreements Futures Options Caps, Floors and Collars. - ppt download

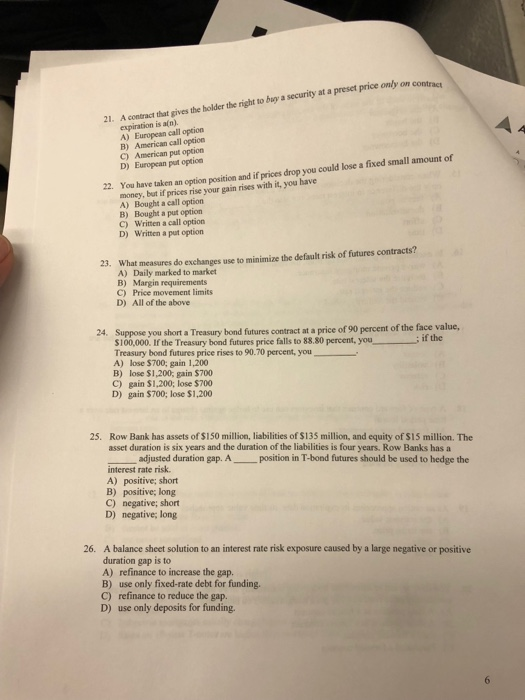

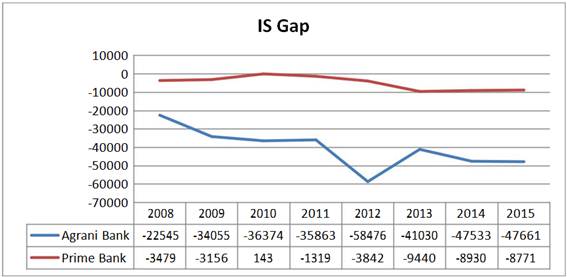

Interest Rate Risk Management of Commercial Banks in Bangladesh Based on IS (Interest Sensitivity) GAP Analysis :: Science Publishing Group

Derivatives in ALM. Financial Derivatives Swaps Hedge Contracts Forward Rate Agreements Futures Options Caps, Floors and Collars. - ppt download

Interest Rate Risk Management of Commercial Banks in Bangladesh Based on IS (Interest Sensitivity) GAP Analysis :: Science Publishing Group